Calls and puts calculator

Enter the maturity in days of the strategy ie. It also calculates and.

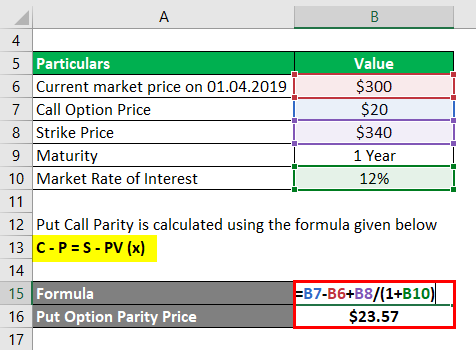

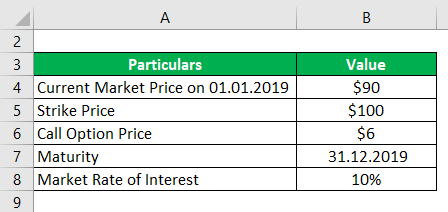

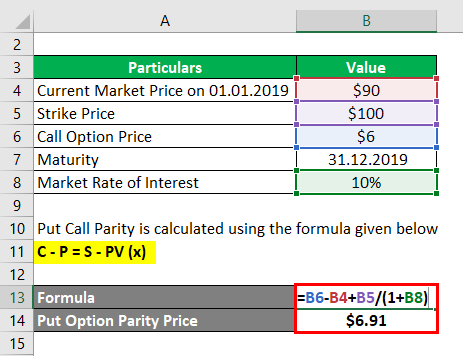

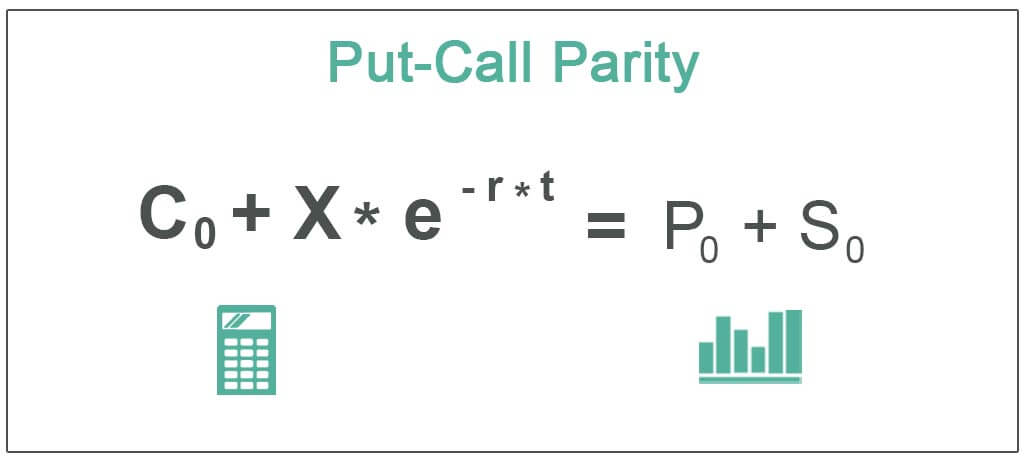

Put Call Parity Formula How To Calculate Put Call Parity

This calculator shows potential prices for both calls and puts.

. Calculate Fair Values of Call options and Put options for Nifty Options and a wide range of other Index and Stock options listed on the National Stock Exchange in India. All options have to. Options profit calculator will calculate how much you make and the total ROI with your option positions.

A Call option represents the right but not the requirement to purchase a set number of shares of stock at a pre-determined strike price before the option reaches its expiration date. You are short the underlying asset and are purchasing call options at one price but also selling calls with the. The bonus is you.

The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option. Excel Profit Calculator. Select your option strategy type Short Call or Short Put Step 2.

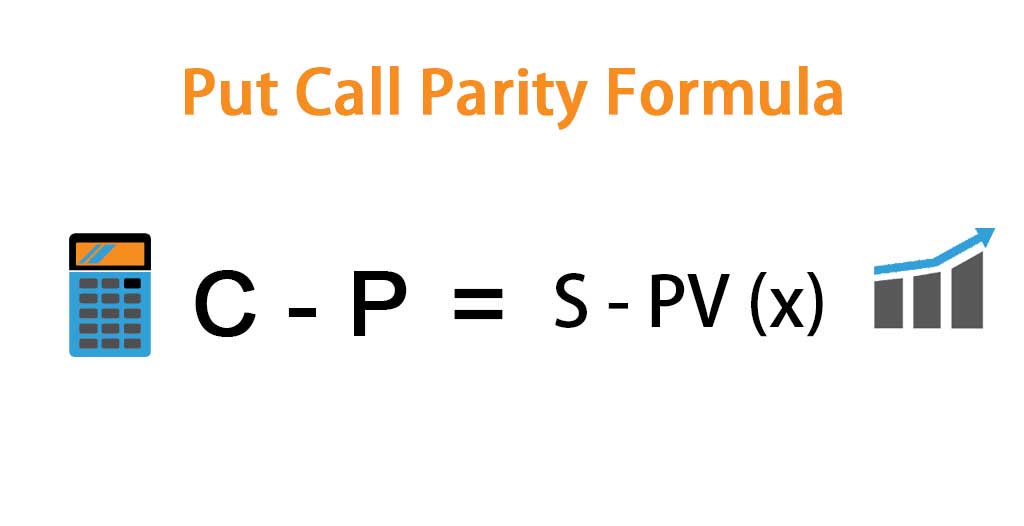

In the put-call calculator by entering the information for the put option underlying asset and strike price you can easily calculate what the put option should be based on the put. All fields are required except for the stock symbol. MIS gives you the auto square-off facility for open positions before market closes.

As a result both downside and upside are. Put Option Calculator is used to calculating the total profit or loss for your put options. Enter the underlying asset price and risk free rate.

Get the most from your trading by just paying a small margin. Enter the maturity in days of the strategy ie. When you buy a call option it gives you the option.

You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model. Enter the underlying asset price and risk free rate. So lets do a quick refresher on each before getting into how to price them.

CallPut Spread Profit Calculator A call spread strategy consists in buying and selling a same quantity of calls but with a different strike price. Each option contract gives you. These calculations are all quite straight forward but if you want to visualize this in excel you can download the handy calculator below.

A moderately bearish bet thats cheaper than a naked put. The long put calculator will show you whether or not your options are at the money in the money or out. Smartly designed order window and order.

The long call calculator will show you whether or not your options are at the. Select your option strategy type Long Call or Long Put Step 2. Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options.

Future Calculator Dividend Stocks Option Strategy Buy Sell Different Strike Earthlink Technologies

Summarizing Call Put Options Varsity By Zerodha

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Put Call Parity Formula How To Calculate Put Call Parity

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Put Call Parity Formula How To Calculate Put Call Parity

Summarizing Call Put Options Varsity By Zerodha

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing Models Formula Calculation

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Using The Free Trade Calculator To Profit On Call And Put Spreads Option Party

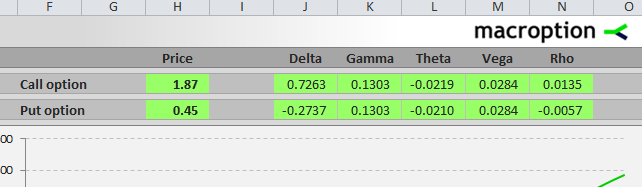

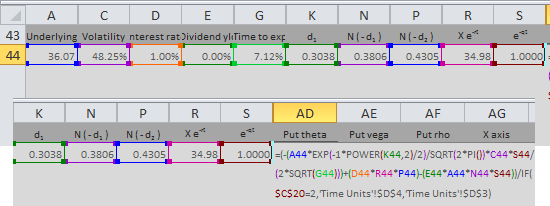

Option Greeks Excel Formulas Macroption

Option Greeks Excel Formulas Macroption

Put Call Parity Formula How To Calculate Put Call Parity

Summarizing Call Put Options Varsity By Zerodha

Call Option Calculator Put Option

/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

Put Call Parity Meaning Examples How Does It Work